In today’s rapidly evolving financial landscape, staying informed about global market trends is essential for making astute investment decisions. As interconnected economies and technological advancements continuously reshape global markets, understanding the forces at play can empower investors to capitalize on opportunities and mitigate risks.

Global market analysis begins with a comprehensive understanding of macroeconomic indicators. Key among these are gross domestic product (GDP) growth rates, inflation, and unemployment levels. Monitoring these indicators helps investors grasp the economic health of a nation and the potential impact on industries and asset classes.

Additionally, interest rates set by central banks significantly influence investment landscapes. Changes in interest rates can alter borrowing costs and affect consumer spending, ultimately impacting corporate profits and stock prices. Investors who track these changes can better anticipate market movements and adjust their portfolios accordingly.

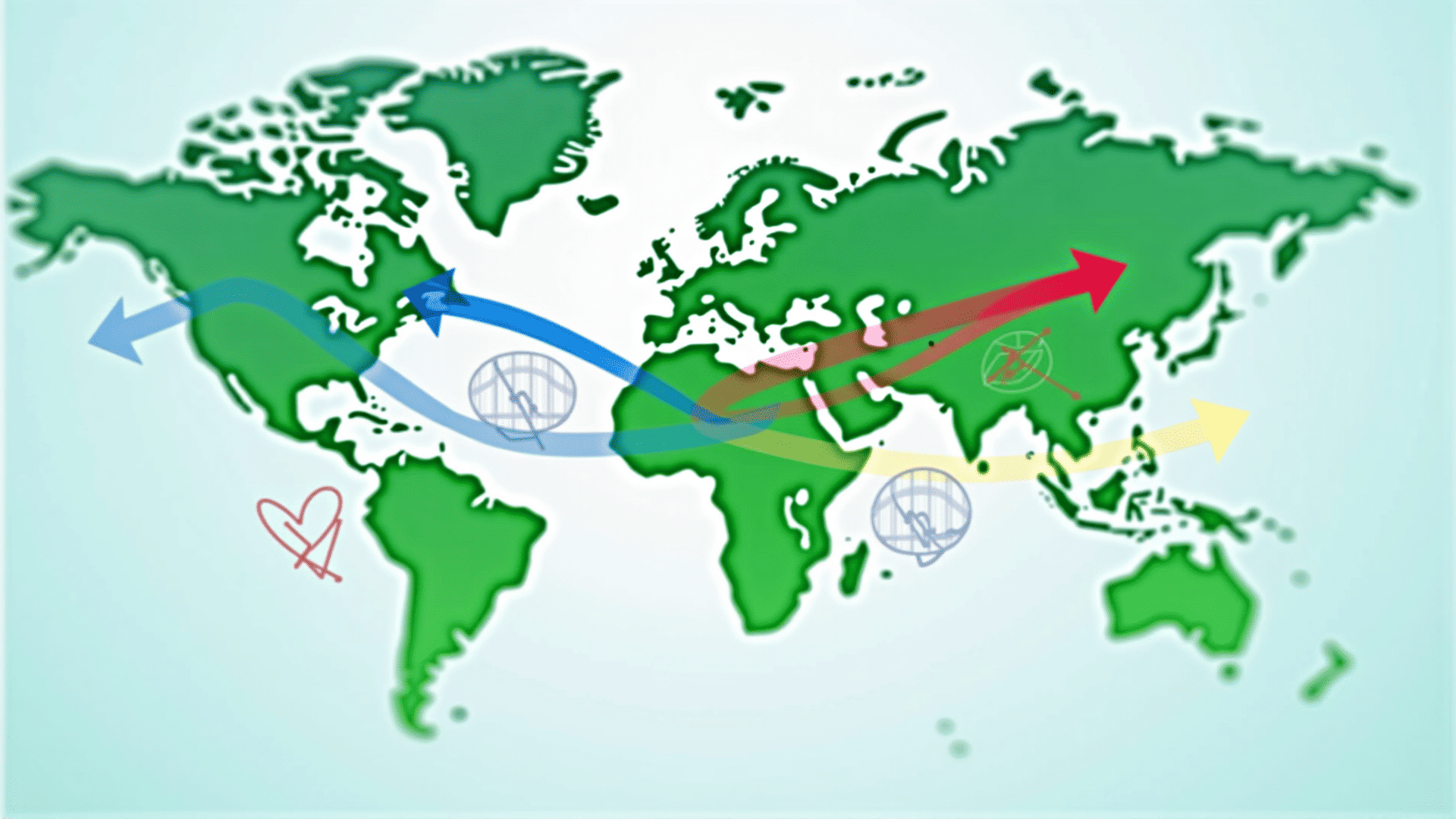

Another cornerstone of global market insights is currency exchange rates. Fluctuations in exchange rates affect multinational companies’ profits when foreign incomes are converted back into domestic currencies. These changes also influence the competitiveness of exports and imports, affecting businesses and economies at large. Investors attuned to currency trends can leverage these shifts to optimize their international investments.

Emerging markets add another layer of complexity and potential to global market analysis. These markets often present high growth potential due to expanding middle classes and increasing consumer demands. However, they also carry unique risks, such as political instability and regulatory changes. An in-depth understanding of local contexts and careful evaluation of risk-reward dynamics is essential when considering investments in emerging markets.

Geopolitical events are another critical factor influencing global markets. Conflicts, trade disputes, and policy changes can disrupt markets, affecting commodity prices, supply chains, and investor sentiment. Staying informed about geopolitical developments allows investors to anticipate shifts and hedge against potential downturns.

Technology and innovation are driving forces that shape markets globally. The integration of digital technologies in various industries is creating new investment opportunities. From artificial intelligence and green energy to biotechnology and e-commerce, identifying sectors poised for exponential growth can yield substantial returns for forward-thinking investors.

To maintain a competitive edge, investors should utilize a mix of quantitative and qualitative analyses. Utilizing big data, sentiment analysis, and predictive analytics can provide valuable insights into market trends that traditional methods might overlook. Collaborating with industry experts and leveraging artificial intelligence tools further empowers investors to navigate complex markets with greater precision.

Ultimately, robust global market insights demand a proactive approach. By continuously absorbing diverse sources of information, participating in industry forums, and networking with professionals across different sectors, investors can refine their strategies and stay ahead of market developments. With an informed perspective, they can make judicious investment decisions that align with both short-term goals and long-term aspirations.

In conclusion, thorough global market analysis is an indispensable tool for investors seeking to thrive in an increasingly interconnected world. By staying vigilant and embracing a comprehensive approach to market insights, investors can position themselves strategically, capitalizing on emerging opportunities while mitigating potential risks. This proactive stance ensures not just survival, but success in the dynamic and ever-evolving global market landscape.